By raising interest rates so dramatically over the past 18 months, the Fed has sent a clear message to those in the commercial real estate (“CRE”) world: “we do not care about you”. Which is to say, they do not care about equity investors or their money. There are too few of them to vote and they are too well heeled to be financially crippled. Their children will still go to private schools. They will not lose their vacation home in the Hapmtons or Sun Valley or Whitefish. They will still take luxurious vacations, buy their Mercedes and Teslas, and dine out whenever and wherever they want. Crushing inflation is all that matters. Inflation is the beast that can cause non-CRE investors to lose their homes, choose between staying warm and eating and being able to survive without taking on 3 jobs.

So, CRE will always lose this fight. Sales volumes across all product sectors are down by as much as 50% to 70%. The institutions are shut down. The only deals being done are smaller private capital transactions that are for the most part sub $20,000,000. Most of those are recaps and bailout of broken capital structures. In some rare cases there are sellers exiting where they have ample equity and are looking to reposition that equity into more value-added pursuits, including rescue capital opportunities. Other sellers are investors, mostly institutional, who have simply thrown in the towel on certain properties due to triage. Focus on the ones that can be saved and leave the rest for the vultures. Indeed, having spent a week on the Serengeti this past summer and seen thousands of vultures, I have come to respect their important place in the ecosystem. AKA “opportunistic” capital, the vultures are sitting high in the trees waiting for the dead wildebeest (mostly class B & C office) to float down the steam.

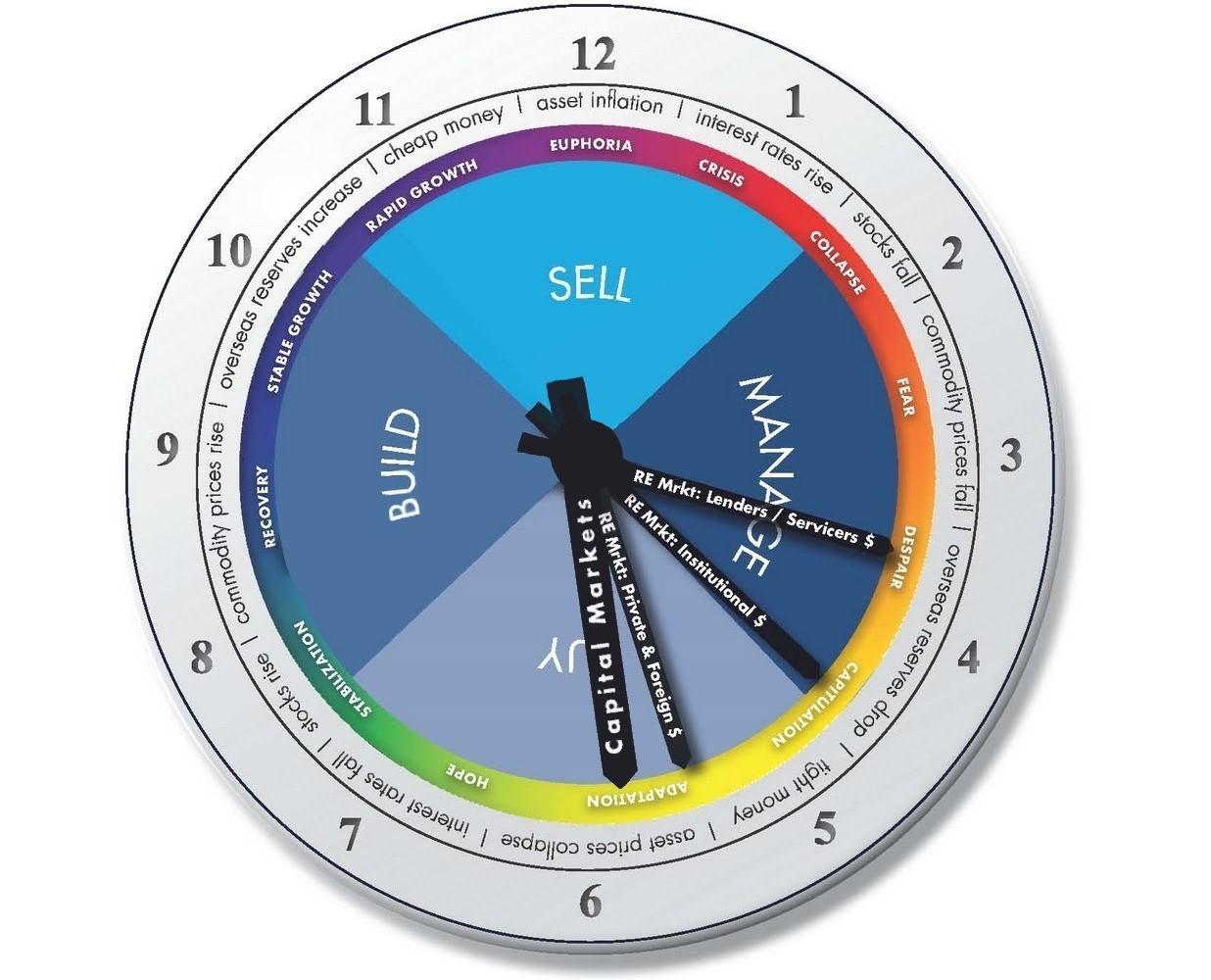

After four decades of seeing boom and bust in this business of CRE, one of the best survival checks is to manage timing – or the circle of life as it were in the Serengeti. The CRE watch can provide guidance on what time it is and what to do. Today most of the hands are pointing to 5:30 to 6:00 pm. Money is tight, asset prices are collapsing, the institutions are out of the market and the private equity (vultures) are sitting by waiting for the poor CRE investors (wildebeest) who are unsuccessful at crossing the river for safer pastures. The vulture and wildebeest both must eat. Unable to determine or predict the future, they are driven by instinct, but like the crocodile who only eats a few times a year, both can be patient. The CRE watch, may just be the best protection the CRE investor has to survive this crossing of turbulent financial waters stirred up by the Fed.

So, what is the watch saying? The answer is “prepare” don’t react too fast or too instinctively. This too shall past. The choppy waters will settle. Interest rates will come back down as the numbers reflect that inflation, measured by annualizing month over month inflation has largely subsided. The economy is solid, but not overheated. Unemployment will stay low as over 3 million people left the labor force and homeowners have a lot of extra money in their pockets thanks to cheap mortgages put in place during covid. Predictability in the capital markets should return in Q4 as debt yields and spreads stabilize. The smart investor is preparing for this more predictable if not tepid crossing conditions. That means, it’s time to secure your capital positions. Postpone development projects while you value engineer costs. You carefully negotiate JV agreements. You push back on debt underwriting requirements and even kick the can down the road on debt repayments and refinancing for a while if necessary / viable. Basically, you want to be ready to buy when it’s 6:00 to 7:00 pm and be prepared to build when the clock strikes 8:00 pm.

The hands of the watch do not move in unison or evenly or smoothly. They usually accelerate around 1 and 7 and move quickly through 2-3 and 8-9. Being prepared is the key to hitting the timing just right. Just as in the Serengeti, good timing is the key to surviving and thriving in the wilds of CRE.

Corion can help you survive and thrive.

Contact us to learn how.